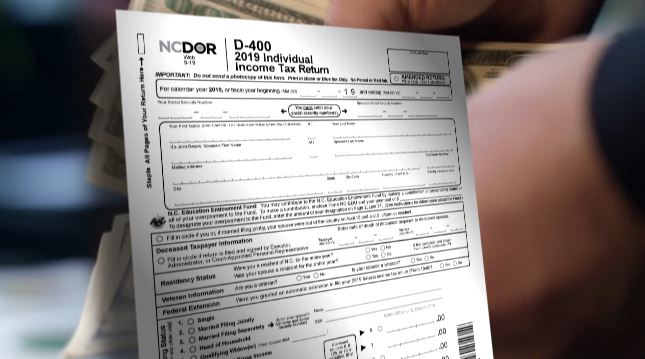

RALEIGH, N.C. (WNCN) – The North Carolina Department of Revenue is working to prevent identity theft as more and more people go to file their tax returns, only to find out someone else has already claimed the money.

Identity theft can happen anytime to anyone. It’s especially prevalent during tax season, and it turns out it’s pretty easy for scammers to get a person’s information.

“It can happen through a data breach if you shop often online, or a situation where you are putting your personal information online,” said Mallory Wojciechowski with the Better Business Bureau.

Criminals are looking for a person’s social security number, as well as other personal information like birthdate, so they can file the tax return forms in that person’s name.

Many will get phone calls from the Internal Revenue Service or the NCDOR saying that they owe money. It’s important to note that neither agency will call or email. Their primary method of contact will be a letter in the mail.

“If you receive a phone call threatening you saying you owe money, that’s a red flag and most likely a scam,” Wojciechowski said.

There have also been instances of scammers claiming to be the IRS or NCDOR writing letters to people. Although the letters are fraudulent, any written communication needs to be checked out before giving someone money.

Red flags to note include:

- A notice about a duplicate return from the IRS

- A notice that another return has been filed using your Social Security number

- A notice about wages earned from a place you’ve never worked

The NCDOR said it stopped $39 million worth of fraudulent tax refunds from going out last year. NCDOR Secretary Ronald Penny said that the department has improved identity theft protections for this year.

“There are more than 100 filters that they will go through, and if you set off some of those filters, that tax form will be separated,” he said. “Then, a human will look at it a lot more closely.”

Penny said the safest way to file is electronically because paper returns can be seen by unauthorized parties or be easily copied.

“Your information is going to be encrypted,” he said. “It’s encrypted when it gets to the IRS, encrypted when it gets to us, and therefore safer.”

He added that electronic forms “make it easier for us to track back who may be getting your info if it happens.” Filing early can also help beat scammers to the punch.

Penny said the NCDOR won’t be prevented from issuing a refund even if a scammer does get it first. Also, anyone who has been the victim of a data breach can give the NCDOR a heads up.

Penny said to call 1-877-252-3052 with any questions or concerns.

LATEST HEADLINES: