One of the biggest beneficiaries of the tax overhaul bill that’s pending Congress’ approval might not seem obvious. But foreign investors stand to come out ahead.

Although President Donald Trump seeks to tighten immigration standards and get tough on international trade agreements, the tax bill — which he supports — treats non-American shareholders in US companies better than most Americans, according to an analysis from the Institute on Taxation and Economic Policy, a nonpartisan think tank.

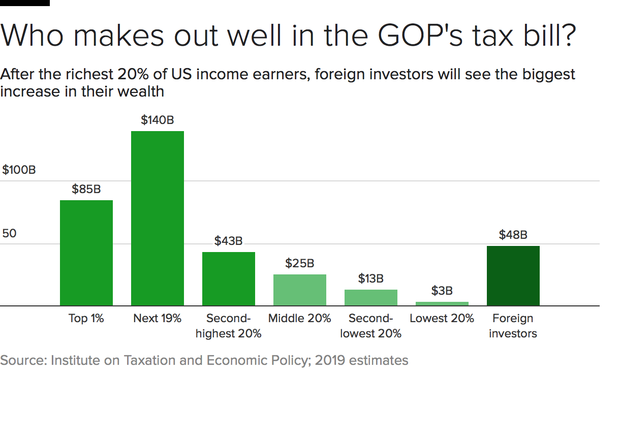

Foreigners will gain $48 billion from the legislation in 2019, the institute calculates, mainly in terms of how their American stock holdings should appreciate, thanks to improved US company earnings fueled, at least in part, by the tax cuts.

If you divide the nation’s population by income into fifths, known as quintiles, foreigners do better under the plan than everyone but the top 20 percent. The richest quintile is ahead by $225 billion, and the second wealthiest by $43 billion, or less than overseas investors.

One big reason for foreigners’ good fortune is the expected power of the bill’s lower corporate tax rate, which is likely to fatten company profits. “Better aftertax corporate earnings lead to share appreciation,” meaning higher stock prices, said Steve Wamhoff, the institute’s senior fellow for federal tax policy. That includes both individually held securities and those owned by mutual funds and other investment vehicles.

Under the tax plan, which GOP congressional leaders want to put on Mr. Trump’s desk before Christmas, the corporate rate would drop to 21 percent from 35 percent currently, which would make the US more competitive with countries’ rates. The worldwide average is 22.6 percent, says the Tax Foundation. US companies that stash billions overseas to avoid high tax rates at home and their shareholders also could gain if some of these holdings return to domestic shores — and fuel dividend increases or stock buybacks..

Higher-income Americans and foreigners are the biggest holders of US stock, Wamhoff said. In fact, 35 percent of American company shares are in foreign hands, by the reckoning of another tax research group, the Tax Policy Center. Congress’ Joint Committee on Taxation estimates that in 10 years, one-fourth of the benefits from the corporate cut will go to regular workers — which dovetails with GOP assertions that more robust profits will lead to more hiring and raises.

For foreign investors, the beauty of US investing is that their assets are generally free of American taxation when sold (although they may owe taxes in their home countries on the American-generated gains). US investors who sell a stock that has risen in price must pay capital gains taxes. For most domestic investors, that means 15 percent on the federal level. The wealthiest (defined as $415,000 annual income for single filers, and $467,000 for couples) pay 20 percent in capital gains, plus 3.8 percent for Obamacare.

Some foreign investors may owe US taxes of 30 percent on dividends from American companies, but many pay at a reduced level, depending on treaties between their homelands and Washington.

Republican lawmakers’ concentration on providing tax benefits for corporations has attracted criticism. One of which is that the corporate cuts are permanent, but many tax breaks aimed at individuals expire after 2025. However, no one is arguing the fact that big investors, whether offshore or on American soil, will reap some of that corporate bounty.