MYRTLE BEACH, SC (WBTW) – As flooding continues to be a concern for the Grand Stand, local and federal agencies are working to implement new precautions.

On Tuesday, Horry County officials met to discuss new flood maps proposed by FEMA. The maps would designate new flooding zones around the county and could take effect in 2020.

As weather patterns continue to change, scientists say it’s imperative leaders keep up.

“There are more people. There’s more at risk. It gets costlier,” Coastal Carolina professor of marine science Dr. Paul Gayes explained. “At the same time, the pressures are changing, they’re getting more intense.”

Dr. Gayes said many factors contribute to the increasing flooding concerns along coastal South Carolina. A combination of warmer waters, rising sea levels, stronger hurricanes and more people in the line of fire all play a role in a complex equation.

To make it little easier to grasp, Black River Outdoors brought News13 to a place where sea level rise has left a clear mark.

Take a drive through Huntington Beach State Park, and you may notice dozens of dead pine trees in one particular marsh.

Naturalist Paul Laurent explained it’s a result of salt inundation, which happens with rising sea waters and high storm surges.

“After Hurricane Matthew, a storm surge washed over this area and the saltwater killed off most of the pine trees,” Laurent said. “This would’ve all been green. All these bare white pine trunks would have been long tall healthy pine trees. You would’ve had thicker underbrush underneath. It would’ve been very, very green.”

Instead, a pine tree graveyard.

“It’s happening everywhere along the coast to some extent or another,” Laurent said. “It depends on where you go and how the exact terrain is shaped. But rising sea levels are putting saltwater further and further in. And if you have a houseplant and you give it saltwater, you know what happens.”

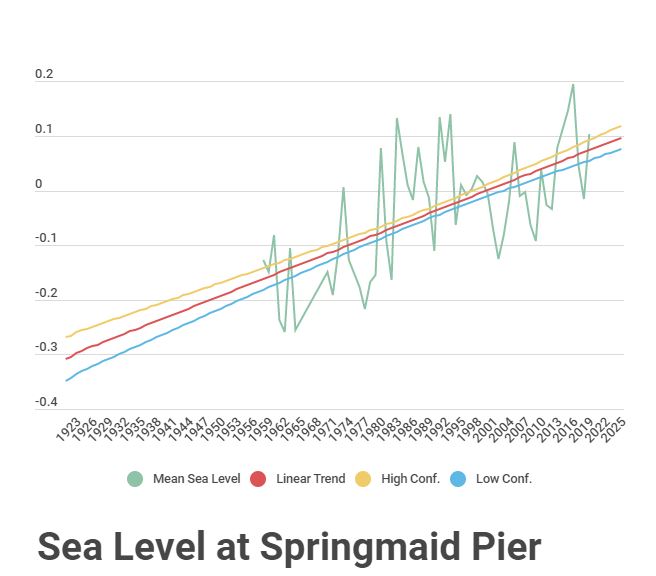

The National Oceanic and Atmospheric Administration tracks sea-level changes around the country.

On the Grand Strand, the federal agency takes readings on Springmaid Pier.

Sea-levels there have averaged a 3.87 millimeter increase per year.

Click on this link to take a closer look at the chart and get year-by-year sea level rates.

Although the number may seem marginal, Dr. Gayes says it’s imperative action is taken before it’s too late.

“It’s not going to turn off tomorrow, but we are a significant part of the changes we’re seeing,” he said. “So we should definitely take care not to aggravate that particular problem in the future. There are things we can do.”

One thing in particular he emphasized was limiting building in vulnerable areas.

“As the risk changes, there may have been areas on the coast that were acceptable in the past but the baseline has come up, they get inundated more and more,” he said “We need to understand the risk a little better. Going into areas that are low lying there’s going to be cost. If we want to do it, and we accept the risk, we need to accept the consequences. How are we going to pay for that?”

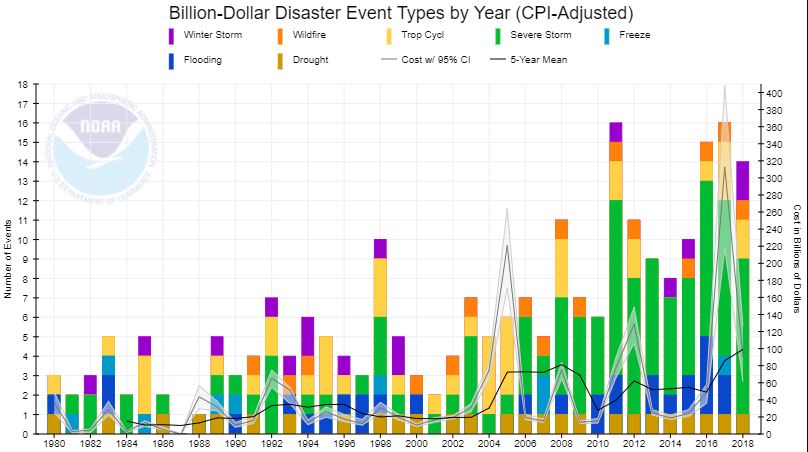

Speaking of paying, he says inaction is costing the U.S. billions of dollars.

Take a look at this chart, which was also compiled by NOAA. It shows the number of natural disasters that cost the country over one billion dollars skyrocketing over the past few decades.

These issues are not cheap, he said.” Huge numbers of people moving along the coastlines around the whole country. It’s a huge part of the growth in our area. So its a huge part of our economic engine but it’s changing the risk equation.”

We asked Myrtle Beach realtor Jacinda Wright how homeowners in the areas can mitigate that risk.

Flood insurance is a big part of the answer.

“The best thing to do is if you don’t need a policy, get one anyway,” Wright said. “Because you could have that freak accident happen. You could have a thousand-year flood come. And better safe than sorry.”

She said homeowners whose property is not in a named flood zone and cash buyers aren’t required to have flood insurance.

But she emphasized it’s a worthy investment to protect your assets.

“I’d rather spend an extra $300 now than spend an extra $300,000 later, she said.”

To see if your home is in an existing or proposed flood zone, head to this link.